What is invoice factoring?

Generally when people hear the word factoring, they think of 8th grade math class. But if you’re in business for yourself and bill your customers, you’ve probably heard of factoring. If not, it’s very important to understand what invoice factoring is. Whenever you bill your customers for payment at a later date, you create an invoice. As your customers pay, you close out each invoice and mark it as “paid”. However should the need arise for quicker payments, you can factor your invoice for cash up front.

Generally when people hear the word factoring, they think of 8th grade math class. But if you’re in business for yourself and bill your customers, you’ve probably heard of factoring. If not, it’s very important to understand what invoice factoring is. Whenever you bill your customers for payment at a later date, you create an invoice. As your customers pay, you close out each invoice and mark it as “paid”. However should the need arise for quicker payments, you can factor your invoice for cash up front.

What is Invoice Factoring?

Invoice factoring is the process of selling your unpaid invoices to a 3rd party finance company. The finance company is usually called a factor or factoring company. In exchange, you receive payment of the invoice up front. The factor will provide 80-90% of the invoice total up front, and collect from your customer. Upon the factor’s receipt of payment from your customer, they rebate the remaining 10-20% (known as the “reserve”), minus their factoring fee. Factoring fees are generally 1-3% of the invoice value itself.

Is Invoice Factoring a Loan?

Establishing an invoice factoring facility with a factor usually is not a loan. However it’s important to understand the differences between invoice financing vs factoring. In short invoice financing is obtaining a loan that is collateralized by your invoices, and invoice factoring is where your business outright sells any and all claims on the invoice payment to the factoring company. Not only is it important to understand the different types of financing mechanisms, but you should also learn to identify loan products disguised as factoring. If you’re not looking for a product that acts like a loan, make sure you obtain a non recourse factoring agreement with a factor.

Why or When Should I use Invoice Factoring?

Invoice factoring is a great cash flow solution for business owners in need of short term working capital who are experiencing a rapid growth in sales, need to buy new inventory, or simply want to match the timing of their income and expenses. Additionally, as you’re diversifying your capital stack, it’s important that you find funding for your business that fits your needs. For example, if you have a short-term capital need, there is no reason to take on long-term debt or sell equity. You can easily monetize your unpaid invoices for immediate working capital.

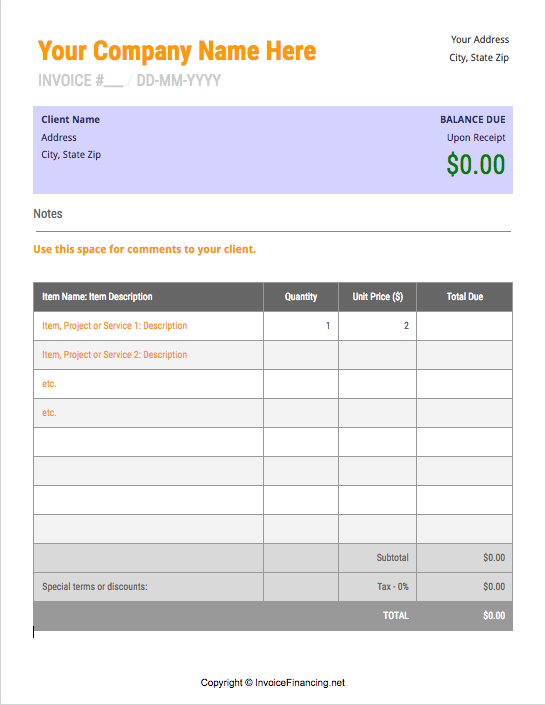

Are you new to invoicing? Download our simple invoice template today!

If you’re a small business owner, you’ve probably received a fax, e-mail or phone call about obtaining a “merchant cash advance”. Merchant cash advances are a form of business funding that should, in theory, fall between a loan and an investment. Because it’s not a loan, there is no “interest” associated with it. Instead there is a fixed payback. The fixed payback is often determined by a “factor rate”, which can be deceiving because

If you’re a small business owner, you’ve probably received a fax, e-mail or phone call about obtaining a “merchant cash advance”. Merchant cash advances are a form of business funding that should, in theory, fall between a loan and an investment. Because it’s not a loan, there is no “interest” associated with it. Instead there is a fixed payback. The fixed payback is often determined by a “factor rate”, which can be deceiving because  Editor’s note: this article is for new business owners and tailored to those who are starting to earn revenue from clients. This article is very elementary and does not apply to many business owners! But if you’re just ramping up your business and a client says to you, “invoice me”, it’s probably best to act like you know what you’re talking about and agree that you will. But it begs to question if you’re unfamiliar, what is an invoice?

Editor’s note: this article is for new business owners and tailored to those who are starting to earn revenue from clients. This article is very elementary and does not apply to many business owners! But if you’re just ramping up your business and a client says to you, “invoice me”, it’s probably best to act like you know what you’re talking about and agree that you will. But it begs to question if you’re unfamiliar, what is an invoice? Many people who start a business generally are aware of the fact that there are three main ways to raise capital. The first is so obtain money from an investor. The second is to obtain money from a bank (i.e. a loan), and the third is to do it themselves by investing their own money. However depending on the type of business you have, particularly what kind of customers you have and how you bill them, factoring invoices may be the best suited option.

Many people who start a business generally are aware of the fact that there are three main ways to raise capital. The first is so obtain money from an investor. The second is to obtain money from a bank (i.e. a loan), and the third is to do it themselves by investing their own money. However depending on the type of business you have, particularly what kind of customers you have and how you bill them, factoring invoices may be the best suited option.