I’ll never forget in college when I took my first accounting course. The professor told us that he couldn’t tell us how many times people mixed up “Cash” and “Accounts Receivable” when doing an accounts receivable journal entry. So he stood there in front of the class room with his arms spread wide and said “here is the difference between cash and accounts receivable”. Then he moved his left hand up and said “cash – you pay me now” and then moved his right hand up and left hand down and said “accounts receivable – you pay me later”. And he just kept repeating it and bouncing his arms:

“Cash you pay me now, accounts receivable you pay me later. Cash you pay me now. Accounts receivable you pay me later.”

He definitely beat this like a dead horse but it was a good lesson because I never forgot. And given that the two are different, so is the accounting and reporting.

Cash vs. Accounts Receivable

If you’re new to being in business for yourself, or just starting to extend favorable payment terms to clients, you may find this article helpful. After you complete a job and have been paid for it, you have to account for that transactions by booking the sale. This is simple enough – you simply will recognize an increase in cash for a corresponding increase in sales. You saw the cash come in, and if you have an increase in cash the only other possible increase is that of sales. But how do you account for the transactions or jobs you’ve completed, but have yet to be paid on? How do you account for those transactions in your Quickbooks, Xero or other accounting software? Below are some basic accounts receivable journal entry examples and the rationale behind them. But first, let’s cover the basics.

Cash Sale Journal Entry

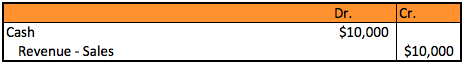

When you sell a product or service for cash, credit card or check (i.e. payment now), you’ll generally book it as a cash account. This journal entry is simple, debit “cash” and credit “sales” or revenue.

Rationale: a Debit (Dr.) to an asset account like “Cash” means an increase, and a credit to an income statement account like “Sales” is an increase. In order to recognize the cash received for the new sale, you would debit cash (increase) and credit Sales (another increase). This keeps debits and credits equal in size. Remember, for debits must always equal credits!

This is the first and last journal entry you must do for a cash sale. But that’s not the case with accounts receivable journal entries (note, it’s not just an entry but more than one).

Accounts Receivable Journal Entry

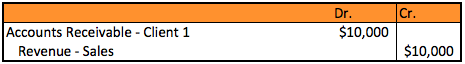

When you sell a product or service in exchange for a future cash payment, you effectively have “invoiced” the client. Issuing an “invoice” creates an “accounts receivable”, meaning an account that you collect on later. Because you’re not receiving cash at the time of the sale or when the service is provided, you must account for it as such:

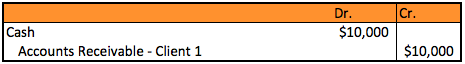

You must book the sale when it occurs, even if you haven’t collected cash for it. Then, when you get paid on the invoice you issued, you do a second journal entry to close out the account and reflect the increase in cash:

Simple enough. Notice how the second A/R journal entry closes out the Accounts Receivable – Client 1 account. In the first entry, there was a $10,000 increase, however when the cash was collected, we increased cash $10,000 and closed out the corresponding A/R account.

If you’re current using invoice factoring, the journal entries will be slightly different. Please contact us at info [at] invoicefinancing [dot] net for assistance with how to account for those transactions.